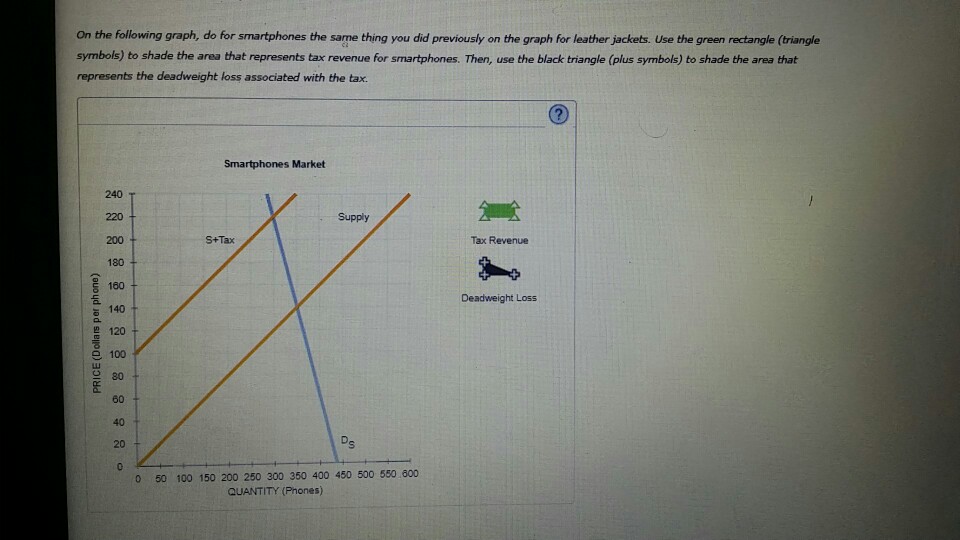

Relationship Between Tax Revenues Deadweight Loss And Demand Elasticity - Web the more elastic the demand and supply curves are, the lower the tax revenue. P q d s 1 s t a x c s t a x r e v e n u e p s. In figure 5.10 (a), the supply is inelastic and. How deadweight loss varies with elasticity. Web deadweight loss = loss of total surplus − tax revenue. A market where a per unit tax has been imposed on the sellers of a.

How deadweight loss varies with elasticity. Web the more elastic the demand and supply curves are, the lower the tax revenue. P q d s 1 s t a x c s t a x r e v e n u e p s. Web deadweight loss = loss of total surplus − tax revenue. In figure 5.10 (a), the supply is inelastic and. A market where a per unit tax has been imposed on the sellers of a.

![Deadweight Loss How to Calculate, Example Penpoin. [2023]](https://i2.wp.com/penpoin.com/wp-content/uploads/2020/11/Deadweight-Loss-caused-by-tax-on-seller.png)